On November 8th, I talked in terms of the ISM manufacturing report and structural rigidity {SR} at

A Macro View: ISM October, More Structural Rigidity. SR, as I use it, is to describe the inflexibility of an economy to change from one state to another state. This is more than just the everyday changes in the markets with one firm gaining and another losing, but more to do with the long-term patterns and trends that change not only the market but in certain ways the society. A prime example was the changing of nearly every aspect of society to go from an agricultural society to an industrial society. For the US, we were in an enviable position that we could politically and economically absorb large quantities of labor from other countries. The result was that the social changes became less severe than other countries that had to "encourage" labor transfer to the factories. Some of that labor was forced out of farming by

Inclosure Acts.

This in no way invalidates the concepts of demand side considerations with respect to the lackluster aggregate demand the US is now facing. Aggregate demand is made up of more than just consumption by consumers, business and government but also investments. How does society encourage this creative destruction through increased levels of investment? R.A. at The Economist explains this need to explore all the various angles at

America's jobless recovery: Improving the discussion.

It should be possible to say both that Republican policies x, y, and z are foolish and that structural factors may be contributing to unemployment. When we arrive at the point that the latter statement must be downplayed because it detracts from the former, then we've seriously degraded the quality of the economic debate.

It also seems possible to say that both the Democratic policies that have been enacted or planned have been been foolish also and that demand side stimulants are also needed.

Structural Rigidity in the Labor Markets, or not?Paul Krugman provides a starting point in discussing these structural employment issues at

Structure of Excuses, where he links to two papers that explore these issues further. The first is an EPI briefing paper #279 entitled with link to

Reasons for Skepticism About Structural Unemployment. The second one is a paper from the Roosevelt Institute entitled with link to

The Stagnating Labor Market. Mike Konczal also explains some of their {along with Arjun Jayadev} findings at

1: Dropping Out Of The Labor Force and at

2: What Can the Employed Tell Us About the Unemployed? What Can the {Under} Employed Tell Us About the Unemployed?Before discussing the second paper on "Stagnating Labor Market", it is important when looking at all the data to ask whether it gives a complete view of the market or only one slice of it. In other words, is there enough data to make a framework for what the economy looks like, or is it just a certain set of data points that may mask and hide the real effects on the economy.

The first post by Konczal presents two important points. The first is that a worker is more likely to end up dropping out of the labor force than being hired, which is affecting the long-term unemployed the most. The second is that people that are deciding to enter the labor force are more likely to join the ranks of unemployed than employed. This is directly related to young people not being able to find a job when finishing their various levels of education. Sometimes they can postpone that decision to join the labor force like going to college, but at some time, that must end also. Although this is not a complete picture of all the factors, this does point to one way that the economy may be suffering structural rigidity, and that is through the minimum wage laws. Wages tend to be sticky especially in the downward direction especially by raising the minimum wage rates like this:

The act raises the federal minimum wage in 3 increments: to $5.85 per hour 60 days after enactment (2007-07-24), to $6.55 per hour 12 months after that (2008-07-24), and finally to $7.25 per hour 12 months after that (2009-07-24). Fair Minimum Wage Act of 2007

It is also interesting to note the Great Recession lasted from December 2007 until June 2009. This is not to say there is a causal relationship but it does make it harder for young people or workers with limited skill sets to find employment at the entry level positions. Even if job applicant is graduating from college, businesses still desire to have some work experience to see if potential employers can handle even rudimentary job responsibilities.

The first post was mostly a look at how bad the labor market is performing now, and the second gets more into the questions of structural rigidity in labor markets (links 1 & 2 above). The writers of the paper provide an unique way of looking at the employment data by looking at the movements of underemployed workers {working less than full-time but desire full time}. They use that approach for two reasons: the first being "skill" sets, as if a person is qualified for the first hour but not full time position then it must be related more to economic factors; the second being that unemployment compensation may alter an workers decision to enter/reenter the work force. Both are good reasons for picking these data sets, but with some caveats. For the skills set, there could be other reasons for the mismatch as employers are adding more part-time workers to build up excess capacity now, but this requires that we assume that not all businesses face the same set of incentives. Talking about incentives, it seems reasonable to say that extending benefits changes people's incentives and thus changes their behavior. The question is an analytical one though.

The first set of data they consider is to look at the part time workers claiming underemployment for economic reasons. The major change of the overall economic reasons has been mostly increased due to the category of slack working conditions. There could always be a bias as this is simply self-reported work situations and they may not know the exact reasons for underemployment from their boss.

The next data sets they look at is comparing the graphs of underemployment rates of first the finance and construction sectors and then non finance and construction sectors and finally across 9 occupations. The graphs are quite similar in appearance and make a good point about not affecting the finance and construction sectors any more than non sectors. It might be helpful to even get a finer detail on the sectors and especially the occupations. They then break this data down in a table comparing average underemployment during 2000-2007 and 2010, across 13 sectors and 9 occupations. The use of ratios instead of just calculating the percentage change seems odd. It is a lot easier to hide the variance when using the ratios. For example the sectors had a range of percent change from 44% to 182% where the ratios were expressed as 1.44 to 2.82.

But I can't help from thinking that instead of constant increases across the sectors and occupations {around double according to the writers} that we should see convergence of rates across them. Take for example a worker looking for a job, would he look for a place that had over 15% underemployed in the work force as in construction and extraction, or just over 2.5% in management? So when looking at the sector data we see that even though mining started out the lowest in underemployment, it gained the least amount to just 44% increase.

It nearly is conflicting data when construction and extraction had the highest level of underemployment as occupations go, but then mining had the lowest in sectors. It could just be too broad of categories to give us fine enough details. The mining sector number does indicate that the US could have a structural rigidity in this sector. More data would need to be examined for that conclusion though.

Overall, the paper brought some interesting theories out and provided reasons to support more of the theory of inadequate aggregate demand. There are bound to be many different ways to slice the structural rigidity problem and so no one set of data will provide all the answers. So areas to look further might be the effects of minimum wage on structural rigidity and also the extraction side of the economy including mining.

Skepticism About Structural UnemploymentLawrence Mishel, et al present the paper entitled

Reasons for Skepticism About Structural Unemployment. They nearly admit that their paper is a process of "critiquing a straw man" and they do this by talking in terms of our "unemployment problem is primarily structural". They do provide a summary of policy implications if structural rigidity is preventing an economic recovery in the employment markets in the following passage.

The policy implications of a finding that our high unemployment is primarily structural are that: (1) it would be foolhardy to use further demand management (fiscal stimulus, either tax cuts or increased spending, or monetary policy) to lower unemployment; and, (2) the appropriate policy is to offer education and training to the unemployed to help them make a transition to new occupations and sectors.

Those ideas are not mutually exclusive and are more complementary. A jobs training policy would in fact act as a stimulus and create demand in certain sectors of the economy. There would still be a need to maintain aggregate demand in the short term since the lag time could be quite long and any long term investment (including human capital) requires positive expectations about the future. What was foolhardy was that the stimulus bills did not include more along these lines of investment.

Let me critique a few straw men. One of the ongoing stories about the current economic slump is lack of mobility of the work force, and the housing crisis certainly has not helped. Homeowners underwater may not be so readily or easily able to walk away from the current house and find another one in the place they wish to move to. Even if someone can walk away with little financial consequence does not mean that the family wants to be renters for some time. Mishel et al. use statewide data to deny this rigidity.

The disparity between states’ unemployment rates is indeed striking, ranging from 14.3% in Nevada to 3.6% in North Dakota.9 In fact, there are 11 states where the unemployment rate in June was less than 7.0%. Still, it is not as simple as a geographical mismatch, with high performing and low performing states. These 11 states with low unemployment have a total adult population of about 17 million, or about 7.0 % of the U.S. total.

It's a good point about the low unemployment states can not accept all the millions of unemployed. But this is too aggregate of data to be really useful and does not tell the whole story. The WSJ blog post,

City Unemployment: Slow Progress, provides a breakdown of data on metro areas. It noted that rates are as high as 29.3% at El Centro, Calif. to as low as 5.8% at Washington-Arlington-Alexandria. For metro areas with jobless rates above 15%, 8 out of the 10 are in California.

(Click on tables for clearer images.)

The above map is from

America's recovery: Where the jobs are | The Economist. While it only provides two ranges of data, it is worth noting the concentrations of red in California, followed by Florida and lastly patchy in the area "across the country's manufacturing belt". The areas doing better are Texas, across the Plains and along the East Coast from Virginia up.

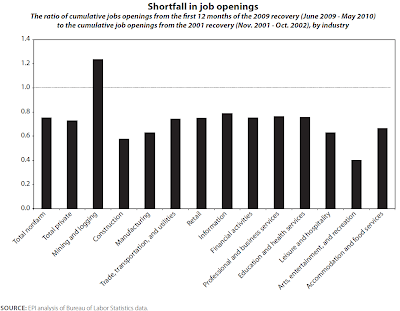

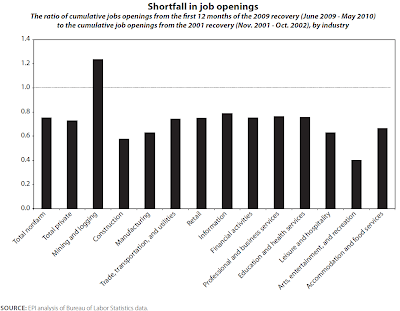

The table above is another way of looking at sector performance. Most of the sectors/industries are well below the recovery of 2002, but we do see that again mining and logging is doing the best overall. I suspect that we would see this same pattern across all resource extraction sectors including farm sectors. The one surprise in the data was that arts, entertainment and recreation did so poorly this time.

The slowdown in construction was expected. But Mishel et al. use that as a point of skepticism about structural unemployment. Their figure is not fine enough data to make any hasty conclusions and they admit that construction labor lost 2 million jobs which "accounts for about 25% of all private-sector jobs lost". They then conclude that many instead of joining the unemployment lines found jobs in other sectors and "some have left the country". In addition to the fact that many went back to their country of origin, some of the workers in construction are considered independent contractors or day laborers and as such may not be entitled to unemployment compensation and thus fall out of the labor pool.

Conclusions:Even if there was no structural unemployment there could still be structural rigidity in the economy. But even with these sets of data, it appears that the labor markets are rigid in certain ways. Ideally the growth across sectors would be very close to the same results and would converge toward a median range. Also the map and metro area data show the divergence of labor markets. We would expect differences in rates but more convergence than what we are seeing.

The data seems to point out that there may be structural rigidity in the resource extraction sectors like mining and logging. If it is showing up in the labor markets and the ISM reports then it seems safe to say that at least some of that is affecting our economy.

Paul Krugman's Words on the Issues.Job openings have plunged in every major sector, while the number of workers forced into part-time employment in almost all industries has soared. Unemployment has surged in every major occupational category.

...

So what you need to know is that there is no evidence whatsoever to back these claims. We aren’t suffering from a shortage of needed skills; we’re suffering from a lack of policy resolve. As I said, structural unemployment isn’t a real problem, it’s an excuse — a reason not to act on America’s problems at a time when action is desperately needed.

Not every sector has plunged, unless he means that mining and logging is minor. It was major enough to be included in both reports. As far as "no evidence whatsoever", then even the reports that claim no structural unemployment are providing clues that there is some. Albeit, small compared to the total aggregates, it maybe the bottlenecks that prevent a smooth transition from the present state to the undiscovered country (the future).

I do not find it as an excuse to do nothing but the need for the US to do things that address the microeconomic market failures that prevent full recovery of the job markets. Part of this is designing stimulus plans that are more targeted toward structural rigidity and creating an atmosphere conducive to investments especially long term projects. Something that Krugman has been unwilling to address.

Market Enhancing or Market Destroying Regulations?Op-Ed Columnist - Structure of Excuses - NYTimes.comDebunking the theory of structural unemploymentFair Game: Blaming Older Workers for High UnemploymentBailouts and Aggregate Demand presents the argument that bailouts are inconsistent with aggregate demand solutions and is more along the lines of aggregate supply solutions.

Spending Money Can Be Difficult for Some Middle-Aged Governments talks about the fact that the US government can not seem to spend fast enough to increase aggregate demand. There are no "shovel ready projects" out there.

Putting Austrian Business-Cycle Theory to the Test - Robert P. Murphy - Mises DailyFirst of all, Austrians can easily explain why there is a general drop in employment after a bubble pops, rather than just drops in (say) capital-goods industries. The problem in the aftermath of a bubble isn't merely that a "given" level of demand switches from one sector to another. On the contrary, people in general are poorer than they thought they were at the height of the boom.

Government actions crippled the economy-how?

Structural Problems, Not Structural Unemployment - NYTimes.comStructural ImpedimentsCritiques of Krugmann:It's the Housing, StupidStructural Unemployment a Myth?Show me the Employment Structural Rigidity:City Unemployment: Uneven - Real Time Economics - WSJAmerica's jobless recovery: Demand, supply, and the Fed | The EconomistCARPE DIEM: Online Job Openings Reach 22-Month High in Sept.The USA falls in Forum Competitiveness RankingsPolitical Calculations: How Much Does It Cost to Employ You?Small Biz Is Still Sucking Wind - The Curious Capitalist - TIME.comLessons from South Africa’s Minimum Wage Problem « Modeled BehaviorUnited States of Wage Gaps - Map of the Gender Gap in Pay by State - NYTimes.comCensus Data Shows Poverty Rates by State in 2009 - NYTimes.comDani Rodrik's weblog: Growth reducing structural changeEconomic growth: Importing job growthEnergy Leaders Blame Oil and Gas Subsidies for Weak Prospectshttp://www.worldwildlife.org/who/media/press/2010/WWFBinaryitem16817.pdf

Less for Success: Builders Roll out New Floor Plans and Projects for the New Market - Design, Marketing - Builder MagazineThe Biotech Advantage Why women start biotech firms at higher rates than they start other kinds of high-tech firms.Fluidity And Mobility: A Newly Defined Middle Class : NPRTraditionalists have argued that dynamic, open-market economies are the most dependable institutions for vaulting individuals and households to a coveted level of income security, whether through entrepreneurship, homeownership, steady employment or the financial cushion of a pension or savings account. Now, these staples of social stability appear to be in jeopardy. That doesn't mean the aspirations have gone away, or that these aspirations don't motivate Americans in the workplace or the ballot box. Quite the opposite. The quest for economic opportunity, aspiring to enter the ranks of a new middle class, is in our cultural DNA.

Misc. Interesting Articles:Hysteresis and Monetary Policy « Modeled BehaviorFree Market Says, "No Thank You" to Loan Programs - The Entrepreneurial MindIn Pursuit of Empirical Macroeconomics, Arnold Kling | EconLog | Library of Economics and LibertyDoes the US Economy Need Another Stimulus Package? - Frank Shostak - Mises DailyUnemployment Rates, an International Apples to Apples Comparison | Angry BearThe Capital Spectator: THE RISING INFLUENCE OF BETAThe Unbearable Slowness of Understanding - NYTimes.com3 Share Nobel in Economics for Labor Market Analysis - NYTimes.comThe Beveridge CurveModels Versus SlogansThe Worst Economist In The World, 10/27/10 - NYTimes.comEnvironmental and Urban Economics: Do High Local Electricity Prices Repel Manufacturing Jobs?Sticky Wages Hold Back Job Growth - Real Time Economics - WSJEconomist's View: Stop the Unemployed from Becoming UnemployableMisc. Links/ISM report:Calculated Risk: Update: Regional Fed Surveys and ISMThe Capital Spectator: ANOTHER DURABLE GOODS REPORT, ANOTHER ENCOUNTER WITH THE NEW NORMALLabels: Macro-Economics