Wednesday, September 21, 2016

Tuesday, September 20, 2016

A Look At A Highly Rated Dividend Portfolio.

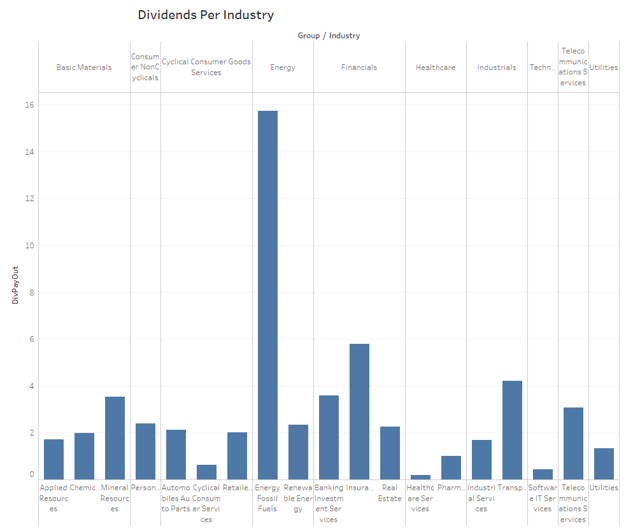

The above graph shows the dollar amount of dividends divided by groups and then industries for a sample portfolio of 41 highly rated stocks assuming constant prices over a 1 year period.

Let us now look at the average percentage return for the same stocks into groups and industries:

The stocks are listed below:

| Group | Industry | Company | Ticker |

| Basic Materials | Mineral Resources | SunCoke Energy Partners LP | SXCP |

| Industrials | Transportation | Navios Maritime Midstream Partners LP | NAP |

| Energy | Energy Fossil Fuels | Transocean Partners LLC | RIGP |

| Financials | Banking Investment Services | Ellington Financial LLC | EFC |

| Energy | Energy Fossil Fuels | Golar LNG Partners LP | GMLP |

| Energy | Energy Fossil Fuels | Frontline Ltd | FRO |

| Financials | Real Estate | Apollo Commercial Real Estate Finance Inc | ARI |

| Energy | Energy Fossil Fuels | KNOT Offshore Partners LP | KNOP |

| Energy | Energy Fossil Fuels | GasLog Partners LP | GLOP |

| Healthcare | Pharmaceuticals Medical Research | Theravance Inc | INVA |

| Energy | Renewable Energy | Enviva Partners LP | EVA |

| Telecommunications Services | Telecommunications Services | Centurylink Inc | CTL |

| Energy | Energy Fossil Fuels | Natural Resource Partners LP | NRP |

| Energy | Energy Fossil Fuels | MPLX LP | MPLX |

| Financials | Real Estate | Xinyuan Real Estate Co Ltd | XIN |

| Cyclical Consumer Goods Services | Cyclical Consumer Services | Gannett Co Inc | GCI |

| Energy | Energy Fossil Fuels | CONE Midstream Partners LP | CNNX |

| Utilities | Utilities | Korea Electric Power Corp | KEP |

| Cyclical Consumer Goods Services | Automobiles Auto Parts | General Motors Co | GM |

| Basic Materials | Chemicals | Braskem SA | BAK |

| Cyclical Consumer Goods Services | Automobiles Auto Parts | Ford Motor Co | F |

| Cyclical Consumer Goods Services | Retailers | Kohls Corp | KSS |

| Basic Materials | Mineral Resources | Ternium SA | TX |

| Consumer NonCyclicals | Personal Household Products Services | Outerwall Inc | OUTR |

| Energy | Energy Fossil Fuels | Valero Energy Corp | VLO |

| Technology | Software IT Services | CSP Inc | CSPI |

| Healthcare | Healthcare Services | Digirad Corp | DRAD |

| Basic Materials | Applied Resources | Greif Inc | GEF |

| Financials | Insurance | Prudential Financial Inc | PRU |

| Financials | Banking Investment Services | Summit State Bank | SSBI |

| Financials | Insurance | Kingstone Companies Inc | KINS |

| Basic Materials | Mineral Resources | ArcelorMittal SA | MT |

| Industrials | Industrial Services | ManpowerGroup Inc | MAN |

| Financials | Banking Investment Services | Timberland Bancorp Inc | TSBK |

| Basic Materials | Chemicals | Trinseo SA | TSE |

| Financials | Insurance | XL Group PLC | XL |

| Telecommunications Services | Telecommunications Services | Nippon Telegraph and Telephone Corp | NTT |

| Industrials | Transportation | Allegiant Travel Co | ALGT |

| Financials | Banking Investment Services | Peoples Bancorp of North Carolina Inc | PEBK |

| Financials | Banking Investment Services | BBVA Banco Frances SA | BFR |

| Financials | Insurance | Willis Group Holdings PLC | WLTW |