QEII: The Hyperinflationistas United for the Revolution!

Questioning the Quantitative Easing Monetary Transmission Mechanism or something like that...

A lot of attributes have been assigned to the actions of the Fed, especially with regard to their policy of Quantitative Easing (QE), including but not limited to the rise in commodity prices worldwide, equity markets taking off, worldwide inflation especially in lower income countries, decline in the value of the dollar, domestic inflation rising, and finally reaching the ultimate in a misery index with stagflation. But in all the theories I have read about, there is no mention as to how the money gets from the Fed to the various markets. This might be called the monetary transmission mechanism as Ben Bernanke wrote about in 1995 in a paper entitled Inside the Black Box: The Credit Channel of Monetary Policy Transmission.

Less formally we could at least say how QE transfers the money from a commercial bank to either highly volatile assets like commodities and stocks to simply speculative instruments like futures and derivatives. We do know that the first transfer is that the Fed purchases long-term financial instruments especially government bonds. But then what happens? Do the bankers hand it over to their cousin Vinny to go bet at the Merc? That seems highly unlikely.

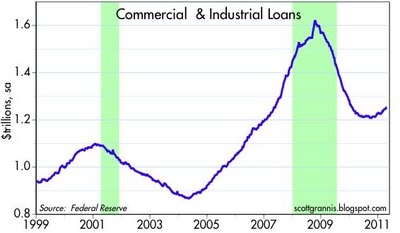

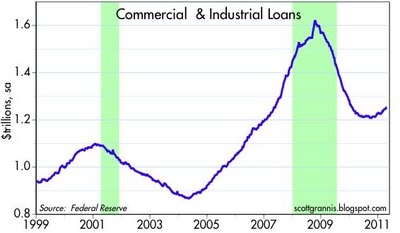

Even if there is More Good News as Bank Lending Continues to Rise, that is still a leap to confirm that the monies are ending up in the hands of speculators or investors in the stock markets.

The fact that Commercial and Industrial Loans are increasing at an 8.6 annualized rate is certainly good news for the economy overall. The important question here is where does the money go after the Fed exchanges cash/money for the government bonds? The last phase of quantitative easing dubbed QE2 started in the later part of 2010 and was officially announced in the early part of November. (Graph: Excess Reserves of Depository Institutions (EXCRESNS))

That graph certainly shows a huge increase in reserves since QE2 came about and in the same magnitude of the total amount of QE2 at around $600 billion. Since the first QE started in late 2008 let us look at a longer term graph.

That is probably not every dollar put into the system from QE1 and QE2, but the rise from near zero to over 14,000 billions (1.4 Trillion!!!) of excess reserves covers the majority of the easing as reported. So what are these reserves doing there if not lent out to prospective borrowers? (Interest Rate Paid on Excess Reserve Balances)

I honestly can not answer why the Fed is paying interest on excess reserve balances. But one thing is clear, quantitative easing is mostly or completely absorbed by the excess reserves, thus it is not a monetary transmission mechanism that is causing some markets to expand.

What is the Transmission Mechanism Then?

The most logical transmission is not a transmission of monies but just a simple change in expectations. If prices are to rise in the future then selling in the future is a better option and interest rates will need to rise accordingly now.

Cullen Roche that blogs at Seeking Alpha provides some cogent discussions about QE2. Commodities react almost instantaneously to new information and adapt accordingly, and at "Fed Contributing Directly to Speculative Behavior" he shows how the commodity prices spiked over the Fed Chief’s press conference. Even though he thinks that QE2 was mostly a flop, he states that "A QE3 Would Only Exacerbate Commodities Speculation, Further Curtailing Real GDP Growth". He may have a point going forward and his biggest complaint about QE2 was that it targeted the amount of transactions and not an explicit interest rate target as normal monetary policy is pursued. In other words, long-term bond rates should have been targeted and amount of transactions ignored which would use more of a signaling to the markets than specific transactions in the market.

Hyperinflationistas...

While most of the recent events can be explained by rising corporate earnings or simply supply and demand, I can not help to think that some of the Inflationistas and Hyperinflationistas took their own advice by buying up commodities and investing more in equity markets. The investments in the stock markets is overall a good thing. Commodities might be pushed higher from this frenzied buying, which could in fact create the necessary political will to reduce the structural rigidity this blog has been talking about. And sure enough with gas costs high, Obama to speed oil production.

Why QE2 Was Hardly a 'Non-Event' - Seeking Alpha

The Bond Market's Inflation-Forecasting Abilities - Seeking Alpha

Bank Lending Update: Economic Building Blocks Start Stacking Up - Seeking Alpha

http://krugman.blogs.nytimes.com/2011/05/15/money-1937-slightly-wonkish/

Impact of Fed Stimulus Debated

Federally Funded Friday - Bernanke Says More Free Money! - Seeking Alpha

GDPhursday - Reality Check - How Much is that Priced in Euros? - Philip Davis - Seeking Alpha

The Bernank Says He Is Responsible For Higher Stocks Not Higher Commodity Prices - InTheMoneyStocks.com - Seeking Alpha

The Transmission Mechanism for Quantitative Easing (Wonkish) - NYTimes.com

Quantitative easing and the commodity markets | The Great Debate

Analysis: Fed's QE2 raises alarm of commodity bubble | Reuters

POMO Thursday: Bernanke Serves Up Another Round - Seeking Alpha

Reserves - FRED - St. Louis Fed

Graph: Excess Reserves of Depository Institutions (EXCRESNS) - FRED - St. Louis Fed

FRED Graph - St. Louis Fed

Interest Rate Paid on Excess Reserve Balances (Institutions with 2-Week Maintenance Period) (INTEXC2) - FRED - St. Louis Fed

Excess reserves - Wikipedia, the free encyclopedia

The Fed initially announced a $600 billion program in November 2008, but then four months later, increased that to $1.8 trillion, when it wasn't enough.

QE1: Nov. 2008-June 2010

QE2: Nov. 2010-June 2011 (estimation)

From RDRutherford:

QE2's Failure and the Housing Market - Seeking Alpha

An Event Study on the Fed and QE2 - Seeking Alpha

The Impact of the Fed's Stimulus Is Debated - Seeking Alpha

Impact of Fed Stimulus Debated

Fed Survey: Big Banks Ease Lending Standards - Real Time Economics - WSJ

Structural Rigidity: War, Counterror Act Like Sand in Economic Gears - Real Time Economics - WSJ

Calculated Risk: Fed: Banks more willing to make consumer loans

Fed�s Hoenig: Rates Should Start Rising - Real Time Economics - WSJ

Fed�s Rosengren Says Recovery Weak, Policy Just Right - Real Time Economics - WSJ

The Fed's Language Problem on Inflation - NYTimes.com

A lot of attributes have been assigned to the actions of the Fed, especially with regard to their policy of Quantitative Easing (QE), including but not limited to the rise in commodity prices worldwide, equity markets taking off, worldwide inflation especially in lower income countries, decline in the value of the dollar, domestic inflation rising, and finally reaching the ultimate in a misery index with stagflation. But in all the theories I have read about, there is no mention as to how the money gets from the Fed to the various markets. This might be called the monetary transmission mechanism as Ben Bernanke wrote about in 1995 in a paper entitled Inside the Black Box: The Credit Channel of Monetary Policy Transmission.

Less formally we could at least say how QE transfers the money from a commercial bank to either highly volatile assets like commodities and stocks to simply speculative instruments like futures and derivatives. We do know that the first transfer is that the Fed purchases long-term financial instruments especially government bonds. But then what happens? Do the bankers hand it over to their cousin Vinny to go bet at the Merc? That seems highly unlikely.

Even if there is More Good News as Bank Lending Continues to Rise, that is still a leap to confirm that the monies are ending up in the hands of speculators or investors in the stock markets.

The fact that Commercial and Industrial Loans are increasing at an 8.6 annualized rate is certainly good news for the economy overall. The important question here is where does the money go after the Fed exchanges cash/money for the government bonds? The last phase of quantitative easing dubbed QE2 started in the later part of 2010 and was officially announced in the early part of November. (Graph: Excess Reserves of Depository Institutions (EXCRESNS))

That graph certainly shows a huge increase in reserves since QE2 came about and in the same magnitude of the total amount of QE2 at around $600 billion. Since the first QE started in late 2008 let us look at a longer term graph.

That is probably not every dollar put into the system from QE1 and QE2, but the rise from near zero to over 14,000 billions (1.4 Trillion!!!) of excess reserves covers the majority of the easing as reported. So what are these reserves doing there if not lent out to prospective borrowers? (Interest Rate Paid on Excess Reserve Balances)

I honestly can not answer why the Fed is paying interest on excess reserve balances. But one thing is clear, quantitative easing is mostly or completely absorbed by the excess reserves, thus it is not a monetary transmission mechanism that is causing some markets to expand.

What is the Transmission Mechanism Then?

The most logical transmission is not a transmission of monies but just a simple change in expectations. If prices are to rise in the future then selling in the future is a better option and interest rates will need to rise accordingly now.

Cullen Roche that blogs at Seeking Alpha provides some cogent discussions about QE2. Commodities react almost instantaneously to new information and adapt accordingly, and at "Fed Contributing Directly to Speculative Behavior" he shows how the commodity prices spiked over the Fed Chief’s press conference. Even though he thinks that QE2 was mostly a flop, he states that "A QE3 Would Only Exacerbate Commodities Speculation, Further Curtailing Real GDP Growth". He may have a point going forward and his biggest complaint about QE2 was that it targeted the amount of transactions and not an explicit interest rate target as normal monetary policy is pursued. In other words, long-term bond rates should have been targeted and amount of transactions ignored which would use more of a signaling to the markets than specific transactions in the market.

Hyperinflationistas...

While most of the recent events can be explained by rising corporate earnings or simply supply and demand, I can not help to think that some of the Inflationistas and Hyperinflationistas took their own advice by buying up commodities and investing more in equity markets. The investments in the stock markets is overall a good thing. Commodities might be pushed higher from this frenzied buying, which could in fact create the necessary political will to reduce the structural rigidity this blog has been talking about. And sure enough with gas costs high, Obama to speed oil production.

Why QE2 Was Hardly a 'Non-Event' - Seeking Alpha

The Bond Market's Inflation-Forecasting Abilities - Seeking Alpha

Bank Lending Update: Economic Building Blocks Start Stacking Up - Seeking Alpha

http://krugman.blogs.nytimes.com/2011/05/15/money-1937-slightly-wonkish/

Impact of Fed Stimulus Debated

Federally Funded Friday - Bernanke Says More Free Money! - Seeking Alpha

GDPhursday - Reality Check - How Much is that Priced in Euros? - Philip Davis - Seeking Alpha

The Bernank Says He Is Responsible For Higher Stocks Not Higher Commodity Prices - InTheMoneyStocks.com - Seeking Alpha

The Transmission Mechanism for Quantitative Easing (Wonkish) - NYTimes.com

Quantitative easing and the commodity markets | The Great Debate

Analysis: Fed's QE2 raises alarm of commodity bubble | Reuters

POMO Thursday: Bernanke Serves Up Another Round - Seeking Alpha

Reserves - FRED - St. Louis Fed

Graph: Excess Reserves of Depository Institutions (EXCRESNS) - FRED - St. Louis Fed

FRED Graph - St. Louis Fed

Interest Rate Paid on Excess Reserve Balances (Institutions with 2-Week Maintenance Period) (INTEXC2) - FRED - St. Louis Fed

Excess reserves - Wikipedia, the free encyclopedia

The Fed initially announced a $600 billion program in November 2008, but then four months later, increased that to $1.8 trillion, when it wasn't enough.

QE1: Nov. 2008-June 2010

QE2: Nov. 2010-June 2011 (estimation)

From RDRutherford:

QE2's Failure and the Housing Market - Seeking Alpha

An Event Study on the Fed and QE2 - Seeking Alpha

The Impact of the Fed's Stimulus Is Debated - Seeking Alpha

Impact of Fed Stimulus Debated

Fed Survey: Big Banks Ease Lending Standards - Real Time Economics - WSJ

| Quote: |

| �The most often cited reason for stronger demand noted by larger banks was greater demand for financing merger and acquisition activity,� the Fed said. Banks, citing increased competition, eased standards on commercial and industrial loans. �Some banks that had eased standards and terms also pointed to a more favorable or less uncertain economic outlook,� the Fed said. Demand for commercial real-estate loans also increased, the Fed said. |

Structural Rigidity: War, Counterror Act Like Sand in Economic Gears - Real Time Economics - WSJ

Calculated Risk: Fed: Banks more willing to make consumer loans

Fed�s Hoenig: Rates Should Start Rising - Real Time Economics - WSJ

Fed�s Rosengren Says Recovery Weak, Policy Just Right - Real Time Economics - WSJ

The Fed's Language Problem on Inflation - NYTimes.com

Labels: Equity Markets, Macro-Economics

0 Comments:

Post a Comment

<< Home