PK: The Great Abdication

Paul Krugman is at it again...and it is hard to keep up with all his distortions, like the lies of Keith Olbermann. Let me start with his his own words.

Obviously a little over the top that Obama considers that Fiscal Stimulus will never be tried again. Wasn't there already the back door stimulus plans and now he frames it as "investments" into our future. Not to say there is not room for more investments in our infrastructures and public goods, but high speed rails and broadband access is hardly something that will create synergies and produce a positive cost benefit analysis.

On the one hand he is right that the "surge" never really showed up in this chart in early 2009. But first, the stimulus was slow in getting started and there were very few "shovel ready projects" out there. Secondly, the growth rate {that is the slop of the line} was steeper than average after the slump in mid to late 2008. I suppose some of that was TARP and other fiscal measures including automatic stabilizers before the states started cutting back.

It is true that Keynesian economists often talk in terms of the G in the equation Y=C+B+G+X-M as total government spending, but when Keynes talked about fiscal measures he was talking in terms of a central government and its autonomous budget process. Individual states are under different constraints and thus are not set up to do fiscal stabilizers for the economy, although it is prudent that they each have a rainy day fund for down turns in the economy. Under Krugman's theory, the G would increase consumption for any shortfall in income, no matter the cause.

More importantly, there was a surge in government spending and fiscal policy stimulus on a massive scale. It was so massive that Krugman clearly can not see it. Other than the dip during mid 2008, government has been continuously surging forward. If he wants to see massive surges in fiscal spending during high unemployment and stagnating economic times, then there needs to be times of "contraction". If government is to control and mitigate the violent swings in the macro-economy, then it must balance its finances over the business cycle.

Although it is hard to see if the UK will meet the following guidelines when dealing with the current worldwide recession, it certainly provides constraints on spending over the long term.

Governments Abdication of Fiscal Contraction

This also leads us to conclude that if "surges" are not really surges because states and localities are reducing consumption at the same time, then where is the fiscal contractions that never have occurred when states and local governments have expanded? Will Krugman alter his Keynesian fiscal policies to reflect his inclusion of all levels of government when considering "surges" and of course contractions?

I wouldn't count on it...

Paul Krugman laments Living Without Discretionary Fiscal Policy.

They would be more politically feasible if when the economy was below the full employment level and the economy was overheated {by historical standards} there was some sign of fiscal contraction. I was always taught that Keynesianism worked best when balanced over the business cycle and not meant as a tool for ever expanding central government control.

Note: he does have a good point about setting a higher inflation target. The IMF has studied this quite extensively and higher rates of inflation for many countries can net higher growth rates. Below 10% rates is considered acceptable without harming growth rates and so the target being changed to 4 to 5% sounds reasonable.

The Means-Testing Mirage - NYTimes.com

The Great Abdication

The important thing, I think, is that he has effectively given up on the idea that the government can do anything to create jobs in a depressed economy. In effect, although without saying so explicitly, the Obama administration has accepted the Republican claim that stimulus failed, and should never be tried again.

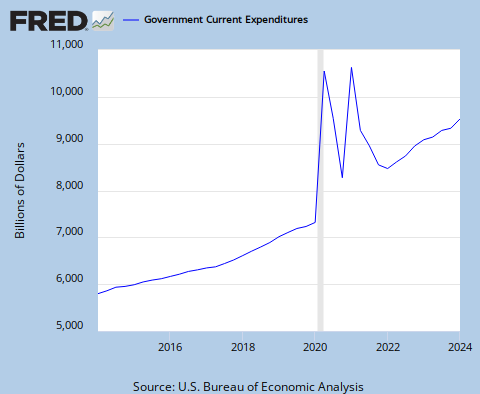

What’s extraordinary about all this is that stimulus can’t have failed, because it never happened. Once you take state and local cutbacks into account, there was no surge of government spending. Here’s total (all levels) government spending over the past 10 years:

Obviously a little over the top that Obama considers that Fiscal Stimulus will never be tried again. Wasn't there already the back door stimulus plans and now he frames it as "investments" into our future. Not to say there is not room for more investments in our infrastructures and public goods, but high speed rails and broadband access is hardly something that will create synergies and produce a positive cost benefit analysis.

On the one hand he is right that the "surge" never really showed up in this chart in early 2009. But first, the stimulus was slow in getting started and there were very few "shovel ready projects" out there. Secondly, the growth rate {that is the slop of the line} was steeper than average after the slump in mid to late 2008. I suppose some of that was TARP and other fiscal measures including automatic stabilizers before the states started cutting back.

It is true that Keynesian economists often talk in terms of the G in the equation Y=C+B+G+X-M as total government spending, but when Keynes talked about fiscal measures he was talking in terms of a central government and its autonomous budget process. Individual states are under different constraints and thus are not set up to do fiscal stabilizers for the economy, although it is prudent that they each have a rainy day fund for down turns in the economy. Under Krugman's theory, the G would increase consumption for any shortfall in income, no matter the cause.

More importantly, there was a surge in government spending and fiscal policy stimulus on a massive scale. It was so massive that Krugman clearly can not see it. Other than the dip during mid 2008, government has been continuously surging forward. If he wants to see massive surges in fiscal spending during high unemployment and stagnating economic times, then there needs to be times of "contraction". If government is to control and mitigate the violent swings in the macro-economy, then it must balance its finances over the business cycle.

Although it is hard to see if the UK will meet the following guidelines when dealing with the current worldwide recession, it certainly provides constraints on spending over the long term.

Fiscal policy in the UK

The Government has also specified two key fiscal rules that accord with the principles. These are:

• the golden rule: over the economic cycle, the Government will borrow only to invest and not to fund current spending; and

• the sustainable investment rule: public sector net debt as a proportion of GDP will be held over the economic cycle at a stable and prudent level.

Governments Abdication of Fiscal Contraction

This also leads us to conclude that if "surges" are not really surges because states and localities are reducing consumption at the same time, then where is the fiscal contractions that never have occurred when states and local governments have expanded? Will Krugman alter his Keynesian fiscal policies to reflect his inclusion of all levels of government when considering "surges" and of course contractions?

I wouldn't count on it...

Paul Krugman laments Living Without Discretionary Fiscal Policy.

Alex Tabarrok makes an interesting point: recent experience seems to suggest that Keynesian policies, even if appropriate, turn out not to be politically feasible when you need them. I don’t think we need to take that as an immutable fact of life; but still, what are the alternatives?

They would be more politically feasible if when the economy was below the full employment level and the economy was overheated {by historical standards} there was some sign of fiscal contraction. I was always taught that Keynesianism worked best when balanced over the business cycle and not meant as a tool for ever expanding central government control.

Note: he does have a good point about setting a higher inflation target. The IMF has studied this quite extensively and higher rates of inflation for many countries can net higher growth rates. Below 10% rates is considered acceptable without harming growth rates and so the target being changed to 4 to 5% sounds reasonable.

The Means-Testing Mirage - NYTimes.com

Labels: Macro-Economics

0 Comments:

Post a Comment

<< Home